GME & the meme stock trend

In January 2021, Gamestop’s share price rose from a close of $18.84 on December 31st to a high of $483 by January 28th, marking roughly a 2,560% price rise. The hand behind this move - at least initially - was not a bank, investment group, or any financial institution, but rather a large sum of retail traders following talk on the Reddit forum WallStreet Bets.

The forum was created to share highly speculative trading ideas, one of which categorized the high short interest in GME as a two-birds-with-one-stone opportunity to make a ton of cash and bankrupt a hedge fund. The conception of this bold idea came at a crossroads with the rise in popularity of commission-free brokers such as Robinhood, providing further accessibility for the millions watching the short-squeeze plans on GME.

“The speculator’s deadly enemies are ignorance, fear, greed, and hope.” - Edwin Lefevre, Reminiscences of a Stock Operator

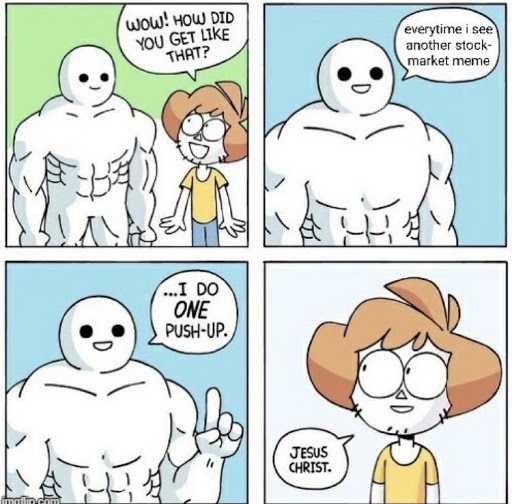

Fast forward six months after the GME spectacle, the short-squeeze trend has yet to subside. WallStreet Bets and other forums are still targeting stocks with high short interest, looking to replicate the GME short-squeeze on these suitors, and so far, they have been successful. AMC, WEN, KOSS, LEDS, BB, CLNE, CLOV, TLRY, BBBY are just a few tickers that have experienced short-squeeze attacks, and more arise almost every other trading day. These are today’s “Meme Stocks.”

The problem is that these movements represent a fundamental divergence from the traditional decision frameworks on which investments and trades are based. Whether you are a fundamental or technical trader/investor, the news catalyst fueling the movement of the stock you’re watching comes in distinct, familiar, and tangible forms: an earnings report, a Hindenburg report, an 8-K form, the resignation of a CEO, the declaration of a partnership with a mass distributor, successful clinical trials, mergers and acquisitions. To many, the “trending on Reddit” catalyst represents no tangible reason for the stock to be moving other than greed, hope, ignorance, and fear.

Where, then, does this leave the “traditional” investors? Do they hop on the meme-stock trend or watch on the sidelines?

A technical perspective

The main argument for trading these meme stocks is that despite the presence of a catalyst that lacks merit, the laws of supply and demand bear no less an influence on price action. If the catalyst is ushering in significant volume, which it unarguably is, then the technical trader’s decisions are reduced to the interpretation of price action, just as it would be on any “real” catalyst that grabs the market’s attention.

In other, simpler words, volume is volume, regardless of where it comes from, and a technical trader’s only job is to correctly interpret the volume and its corresponding price action, just as he does with any other stock that typically meets his selection criteria. If his strategies encompass the price action that is being observed, there should be no difference to his approach other than adjusting for high risk via position sizing and other techniques.

Still, technical traders may shy away from the meme stock trend for other reasons.

- Extreme volatility may dissuade traders from looking at meme stocks because they change price too rapidly to allow the trader to appropriately manage risk.

- Slippage may dissuade traders from initiating trades on these setups because they cannot enter and exit at the price points they want to and, therefore, cannot appropriately manage risk.

- Short-seller manipulation may dissuade a short-seller from initiating a position on a meme stock because it’s public knowledge that these stocks are being targeted for short squeezes.

- Strategy misalignment may dissuade a trader from taking trades on meme stocks because their volatility makes it difficult to execute the trader’s strategy with any form of consistency.

- Timing may be crucial for those traders that are looking to take longs on the uprise of a short squeeze or short the downside of it. From that perspective, the risk of mistiming an entry is potentially catastrophic.

For many traders, the presence of the risk factors associated with meme stocks, all of which could be reduced significantly by sticking to stocks unaffected by the meme trend, is enough to justify ignoring their high reward. For others, especially those whose strategies and risk management protocols align well with high volatility moves, these meme stocks are a huge opportunity to capitalize on lively price action.

The bottom line is it’s possible to trade these stocks using purely technical concepts and make money consistently, but whether that is something right for you is a complete other question.

In trading and investing literatures, a short squeeze is a completely technical occurrence and has no bearing on the stock’s fundamentals. You could argue that, in the long term, short squeezes don't have much of an effect on a stock’s price, as the downside of the squeeze typically brings the stock’s price back to what it was pre-squeeze.

As GME holds on to its $200 per share valuation some six months after its initial squeeze, naive investors and traders may be flirting with a model that focuses on buying stocks that are short squeezing in order to profit from the move long-term (i.e. 3-5 years down the line).

This is a recipe for disaster, as short-squeeze bubbles may form for a while after the initial squeeze, giving the perception that the stock is now “fundamentally changed” but this is not true. Additionally, if the stock’s fundamentals do not change, then the short-squeeze candidate remains overpriced and bound to be targeted for future shorts.

Finally, GME is not the typical example of a short squeeze. Short squeezes tend to have a much shorter lifespan, so the long-term investors would suffer strongly and quickly from any kind of fundamental approach to trading these moves.

Of all the possible risks of long-term investments in short-squeezes, a central risk is the abandonment of the principles of fundamental trading, which require tangible reasons for the stock to be under or overvalued. This is not to understate the effect technical traders have on a stock’s price. Speaking about the issues with most fundamental models, Mark Douglas, author of Trading in the Zone, says:

“The problem with these [fundamental] models is that they rarely, if ever, factor in other traders as variables. People expressing their beliefs and expectations about the future makes prices move.”

While the importance of the presence of retail traders cannot be ignored, their beliefs and expectations during this Meme Stock trend are much more open to scrutiny.

The Meme Stock trend has taken the stock market by storm, causing huge spikes in volume and price on unsuspecting candidates and asking difficult questions of traditional investors and traders. We examine the perspectives of technical and fundamental traders and find a technical perspective is valid, given the trader is comfortable with the added risk and their strategy and risk management protocols are befitting of these kinds of moves.

We also acknowledge that we are in unprecedented times: the stock market has never been more accessible. We do not know how long this Meme Stock trend will continue, and if it continues, how it would affect the fundamental standing of a company.

All we know is that retail traders are hungry and are here to stay.

Wall Street, watch out.

Disclaimer

DO NOT BASE ANY INVESTMENT DECISION UPON ANY MATERIALS FOUND ON THIS WEBSITE. We are not registered as a securities broker-dealer or an investment adviser either with the U.S. Securities and Exchange Commission (the “SEC”) or with any state securities regulatory authority. We are neither licensed nor qualified to provide investment advice. We are just a group of students who diligently follow industry trends and current events, then share our own advice, which reflects our personal position in the market.